The Décennale Insurance (l’assurance décennale) in France is the mandatory insurance policy that protects property owners in France against defects that may arise within ten years after completion of building works.

It is a legal requirement for a professional to have the required insurances in place. The punishment can be up to €75,000 or 6 months imprisonment. Below are guidelines for how this building insurance applies, the process of approving works to a property, and possible risks to the property owner.

What is the Décennale Building Insurance?

When a building contractor undertakes construction work, by law part of the work is guaranteed for a period of up to ten years.

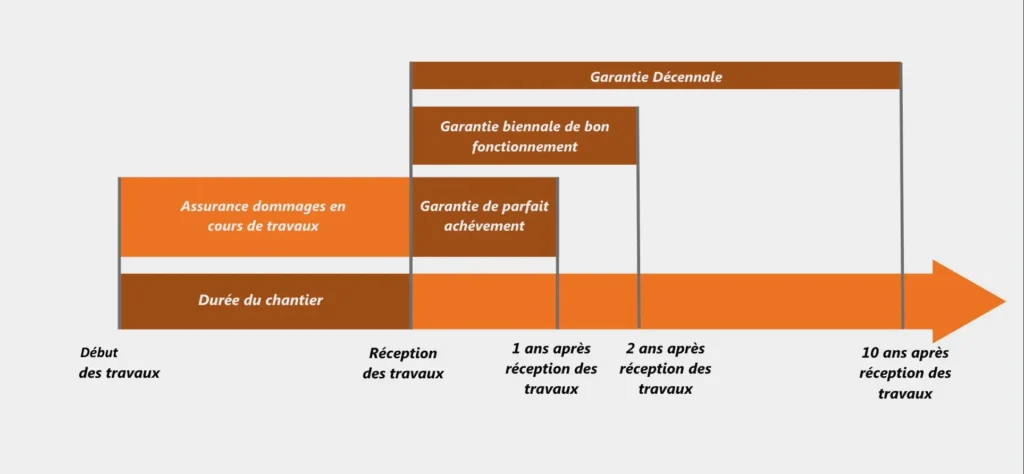

This works under the following tiered structure:

One Year Guarantee – la garantie de parfait achèvement (PGA)

In the year following the completion of the building works, the builder is obligated to guarantee complete performance of the work.

This means that the builder is obligated to repair all defects reported in the works in the first year after delivery.

Two Year Guarantee – la garantie de bon fonctionnement

In the two years following the completion of the building works, the builder is obligated to guarantee that all the separable fittings (items that can be removed without damaging the frame) are in good working order. This includes things like:

- Electrics (entry phone, air conditioning, ventilation)

- Sanitary fixtures (WC, bath, shower etc.)

- Plumbing components (sinks, radiators, fittings, pipes, water heaters, hot water tanks)

- Windows and interior doors

- Shutters

Ten Year Guarantee – la garantie décennale

In the first ten years following the completion of the building works, the builder is obligated to guarantee works that affect the stability and integrity of the building. This refers to structural work or substantial equipment that are inseparable from each other. This refers to items that cannot be removed, dismantled or replaced without deterioration/removal of material of the frame, such as:

- Foundation and building framework

- Floors, walls and ceilings

- Staircases

- Door and window frames

- Cabling and electrical networks housed in the walls, ceilings and floors

- Roof

- Central Heating

- Plumbing embedded in the structure of the building

- Swimming pools, fencing and roadways

Approving the Work

Following completion of a job, the building contractor will produce a report (the work acceptance report) that will be signed by the two parties (the client and builder) or three parties where the works concern an architect.

This report has legal significance and details:

- Completion date of works

- Transfer of ownership of work

- Starting date of guaranties and insurance

- Schedule and timelines of the project

- The identification, management and resolution of any defects or issues

Risks to the property owner

1.Understanding what is and isn’t covered

There are many further intricacies in French case law relating to what is deemed as separable or inseparable from a property, and therefore which works fall under la responsabilité décennale or not. These can be particularly complex, such as for example the method by which tiles are adhered to the property.

For renovations, the Décennale does not cover those parts of the building that existed before the works. However, if these parts become a permanent part of the new construction, then the insurance would cover them. For example, if an extension is being built onto an existing property and the existing walls become part of the new structure, then insurance would cover those walls too.

2. Individuals completing construction work

When an individual does construction work on their home, which includes renovation, extension or elevation work, they are considered to be a ‘builder’ by law. This means that if any damage occurs as a result of the work, even when new owners have moved in, the previous owner can be held responsible.

3. Construction companies operating without insurance

There are significant risks to working with this kind of contractor such as if a worker is injured on site, this may fall under the client’s responsibility and they could be responsible for any financial compensation.

Buying and Selling a Property under the Décennale

When selling a property, it is important for the seller to have insurance in place, especially if they are a building professional, as they can be subject to criminal penalties if they sell a property without it.

Even for non-professionals who renovate, their responsibility can still be engaged within ten years of the work if the property is not insured. This may lead to financial consequences. Any sale of a property without the Décennale must include a clause in the deed of sale mentioning the absence of the insurance, at the risk of the buyer.

Civil Assurance

It is important not to confuse the Décennale insurance with civil assurance (l’assurance responsabilité civile – la RC), the latter being a further compulsory insurance in the construction industry. This insurance covers the liability of the building professional and all damage that happens on the construction site, such as machine failure and bodily injury.